Gold Reserves

Gold Reserves

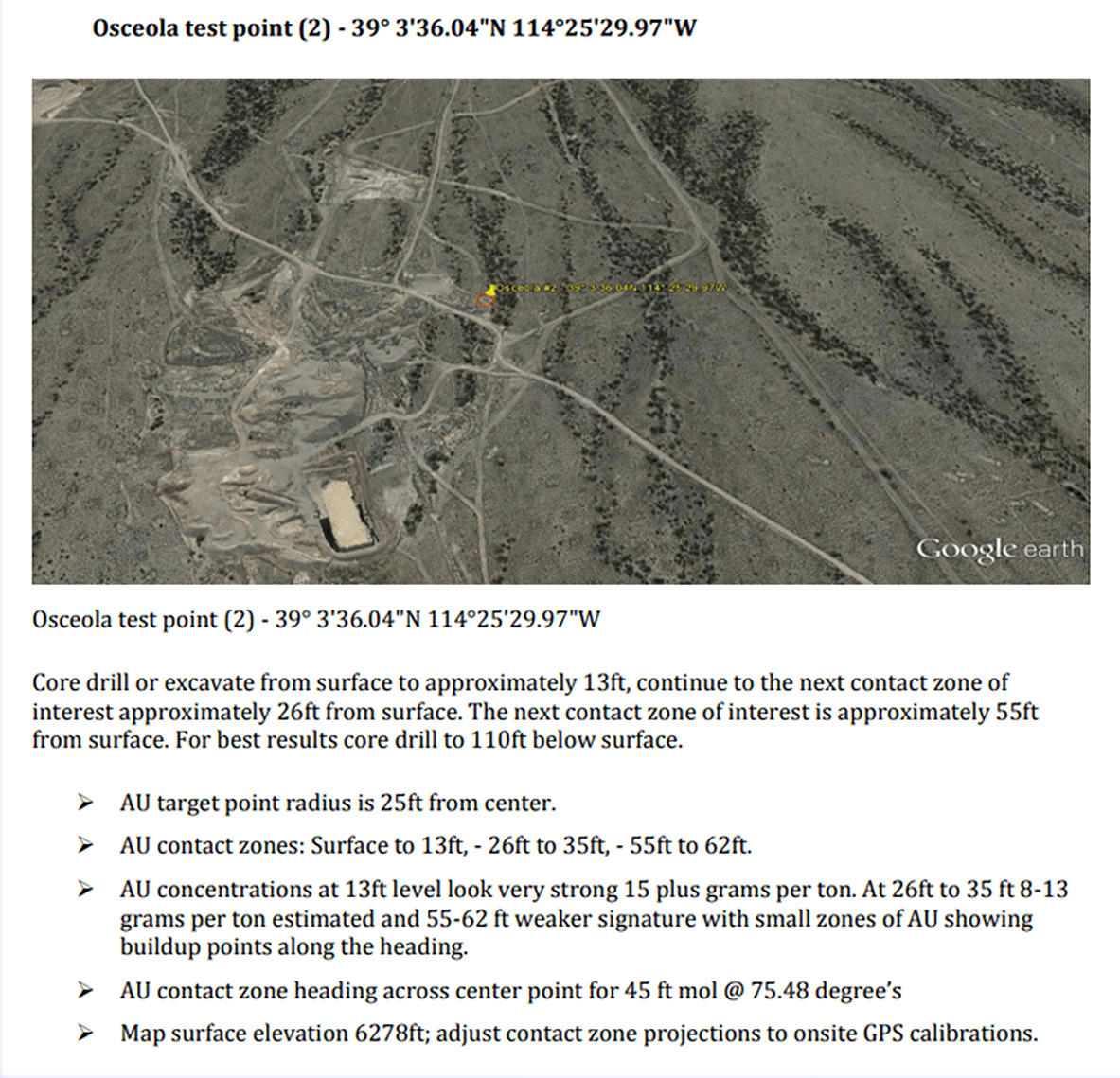

Osceola Gold is sitting on a wealth of untapped gold reserves. Outside of the abundance of reserves equating to almost $4 Billion the quality of the gold reserves is considered of a much higher grade than comparable mines. Additionally, Osceola Gold is well above the threshold for quality paydirt. Due to the mining area being relatively untapped to this point the upside potential could be enormous.

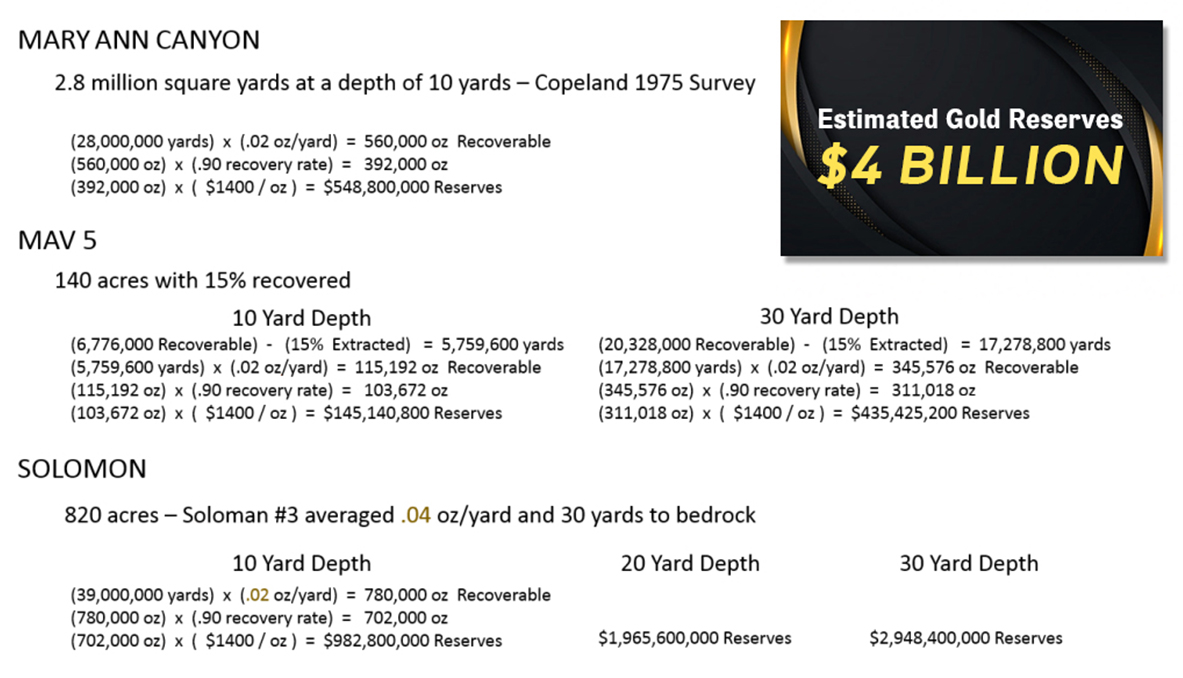

ESTIMATED GOLD RESERVES

The 2010 Skookum Geological Report from 2010 into the current gold price investors can extrapolate the revised value of the reserves. In addition, recent mining revealed the stratigraphy from the MAV #5-H claim contains gold from the surface to the bedrock. The reports also indicate that the average yield in Solomon#3 was over double the other claims. The claims can be broken up into 3 districts, the Mary Canyon, MAV 5, and the Solomon claims.

The formal study done by the Skookum Geological Report was taken and readjusted to $1400 gold price in the graphic above and uncovered proven reserves of $1.68 billion. The overburden is estimated at just 10 –30 feet before the paydirt is uncovered making this a simple earthmoving project. Even though there is no feasibility study, the technical mining plan is clear and straightforward. The satellite photos clearly define the placer channels and the alluvial fan. The company will scoop up the pay dirt in these channels process it through the wash plant and recover the gold. The gold being recovered is close to 20 karat quality and through improved mining methods up to 90% of the gold can be recovered. With a current production capacity of only 100 tons per hour and assuming non-stop production, it would take approximately 32 years to go through just the Mary Canyon region. Based on this pace it’s reasonable to assume the company will quickly ramp up production to expand operations saving investors from a costly round of dilution.

According to Mining.com, gold pay dirt is reported in grams per tonne (g/t) and works out to $45 per gram assuming the current spot price of gold is $1400 per ounce. High-grade gold is classified as anything over 2grams per tonne for bulk tonnage mining. The pay dirt at the Osceola Mine is well above the threshold for high-quality pay dirt. The other factor to consider is the thickness of the pay dirt. A good thickness is about 100 meters deep.

The average yield on the processed pay dirt was 5 g/t which includes the processing of pay dirt during periods where the crews experience everything from frozen pipes to a broken shaker screen. The key takeaway is that these tests were under very harsh conditions and that there may be a considerable upside to the yield once operations begin. The company commissioned a survey from Geo Scan in June 2016 which unveiled concentrations up to 15 g/t. To give investors perspective look at the Aurelian Resource expel which had intercepts of 216 meters of 12.8 g/t in its Fruta Del Norte Deposit in Ecuador, which is currently owned by Lundin Gold (FTMNF). On the news, the stock shot from $2.00 to $22.00. The extreme grade and thickness of the pay dirt played a major factor in valuation. No premium in terms of market capitalization seems to be given for this high-quality paydirt.

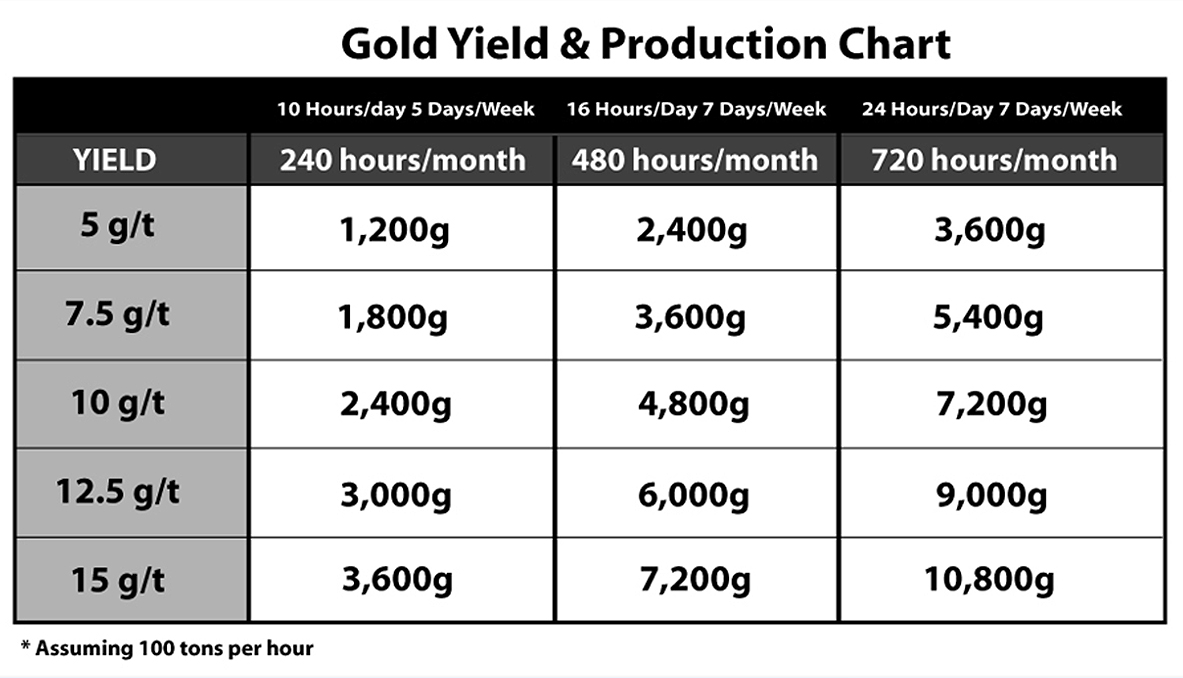

A Komatsu 380 front loader can normally scoop 6 yards of dirt into a bucket. Each yard of ore normally represents 1.5 tons. This means 6 yards in a bucket equates to 9 tons with each scoop. At 1 g/t a bucket is worth $405 ($45 x 9 tons). At the Osceola mine, the worst-case scenario for a bucket of ore is 5 g/t which means each scoop of the front loader is worth $2025! On the high end or 15 g/t each scoop could be worth as much as $6075. At full-scale production, the company estimated 100 tons per hour which is equivalent to 11 scoops per hour. Using the worst-case scenario yield of 5 g/t that equates to $22,500 per hour when they are at full-scale production.

Using the chart above reveals the worst case and best case production levels through some simple multiplication. Assuming 5 g/t and a 240 hour month simply take 1200 g and multiply by $45. So on the low end, it ranges from $54,000 monthly up to $486,000 at max capacity.