Market Analysis

Market Analysis

It is important to understand the market and competitive landscape when making decisions on investments. There are multiple factors to consider when reviewing the potential opportunity growth of Osceola Gold. Reviewing other Junior Mining Companies in the same space is a way to gauge gold quality, estimated reserves versus stock price and valuation. Additionally consideration must be made to competitive companies in the current OTC trading space based off their relative stock structure, estimated reserves future timelines and catalysts.

COMPARBLE JUNIOR MINING COMPANY ANALYSIS

*Data report updated December 2020.

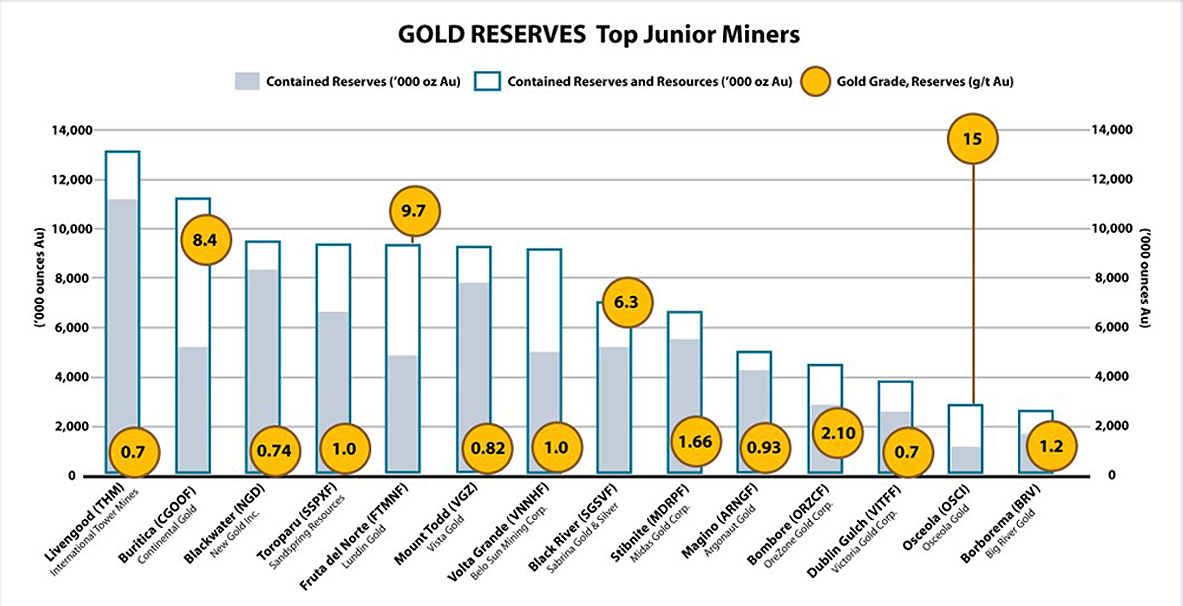

There are 3 primary data points to look at when evaluating a junior mining company. The most important factor is measured and indicated reserves known as proven and probable reserves. These reserves are calculated by a geologist and approximate the number of ounces that could be recovered if mining operations commenced. The next factor investors want to consider is the longevity of the project after they mine out the proven reserves. These are essentially the estimated or inferred reserves that the geologist can reasonably estimate from the core samples and geology. The final element is the quality of the ore. The higher the quality of ore, the less risk that the mine will be shut down due to low commodity pricing. Therefore it’s essential to look at the grade of the ore and the cost of extraction when evaluating the risk. Placer deposits typically enjoy the lowest cost of gold production and can weather any commodity cycle and therefore have the lowest risk profile.

CAPITAL EXPENDITURES AND DILUTION (CAPEX)

*Data report updated December 2020.

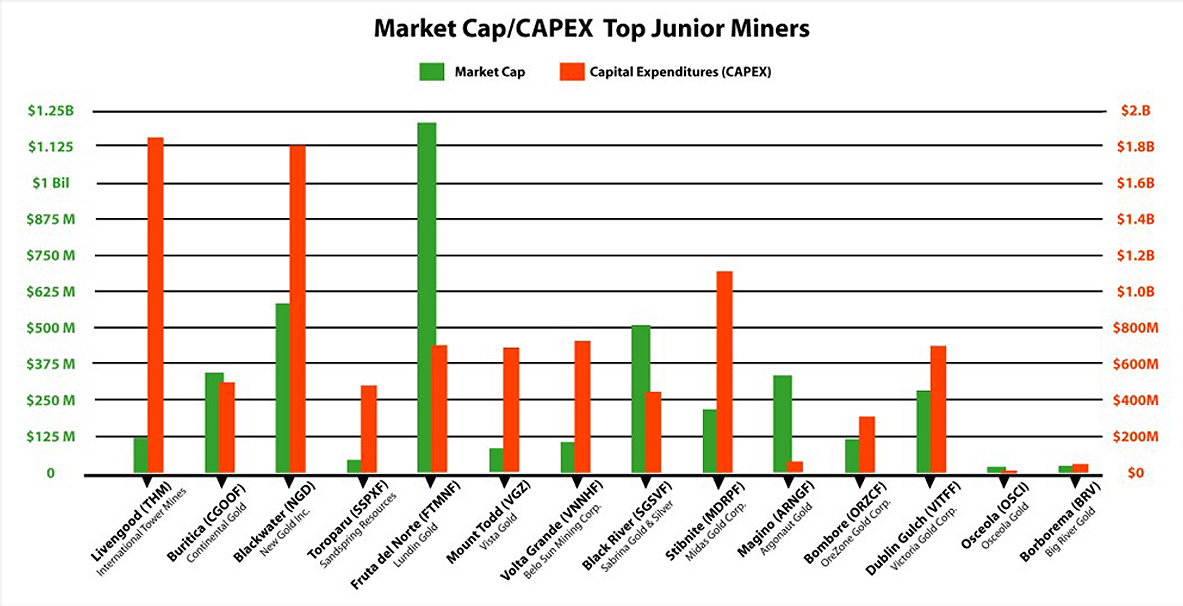

Planned CAPEX plays a major role in evaluating the potentially dilutive impact on the stock price. A very high CAPEX means that a lot of money will need to be raised in the future to get the mine operational. A low CAPEX traditionally means that it will take less fundraising to get the mine operational. There are instances however when a low CAPEX is not good. For example, if the company isn’t investing in technology to extract the metal more efficiently, then that could pose a risk to the company. The highest CAPEX project among the junior miners is the Livengood project. That mine will usurp a large amount of funding even though the project contains massive reserves. The other drag on the Livengood project is the relatively low quality of the ore. In contrast to the Livengood project the Osceola project has virtually no CAPEX risk and is essentially operational. The Osceola project also enjoys the benefit of a high-quality ore making it one of the safest projects to invest in because the risk of dilution is so minimal.

VALUATION

*Data report updated December 2020.

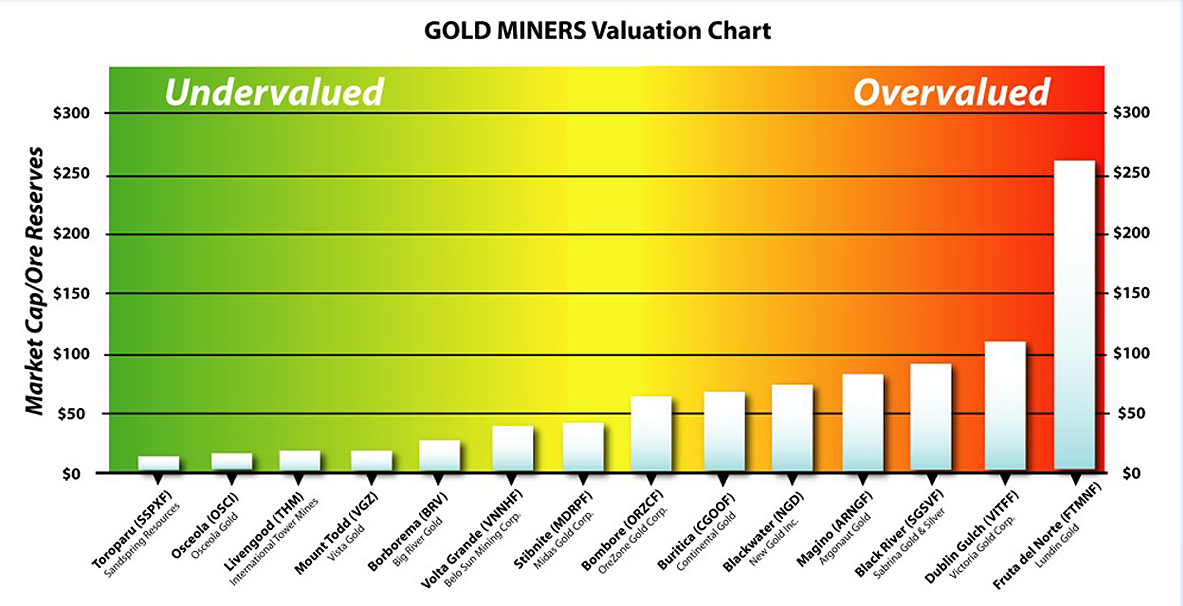

One way to evaluate the miners is to normalize their market cap with respect to the size of their reserves. This ratio in effect reveals if the miner is either undervalued or overvalued. The glaring standout on the Gold Miners valuation chart is the Fruta del Norte mine which appears to be grossly overvalued but adjustments must be made due to its high quality of ore. Only OSCI contains a higher level of ore than the Fruta del Norte mine. By all measures, the Osceola mine is the most undervalued property in the sector.

COMPARABLE COMPANY SECURITY DETAILS ANALYSIS

*Data report updated December 2021.

All investors must navigate the market as they analyze potential opportunities. In order to make the best decisions possible, they must review the sector, competitors, and security details. Evaluating these details is critical to any investment decision.